Fungibility and more. Get to know the main features of tokens

When you think about tokenization, fungibility comes straight to your head. It’s because these two terms seem inseparable. In recent times companies have been using tokenization for many purposes. For example, it supports the trading of luxury goods, real estate, or works of art. Facilitation of this kind of activity is well-demanded. Tokenization helps in dealing with strict international regulations. The question is – which features make this process so welcome in businesses worldwide? Let’s go through tokenization and its main features.

What is tokenization?

Before we move on to the heart of this article, it’s important to recall the definition of tokenization. To put it simply, it’s the comfortable way of trading or exchanging tokens – the symbols that represent goods, and assets. We all know what lies behind every token and how much it is worth. Thanks to that, we know the subject and value of all transactions made on this market. Businesses of every size (including startups) are open to this solution because they care about the ease, clarity, and cost-efficiency of e-commerce transactions. Last but not least, this activity requires full compliance with industry standards and official regulations. Tokenization covers it all.

Fungible tokens

If you were to ask a person experienced in blockchain technology about the most common feature of tokenization, he or she would probably suggest fungibility. And it’s completely understandable as one would always appreciate the facilitation of all trades and exchanges. Fungibility is a feature that allows easy replacement of goods or assets with the return of the same value. Money is a leading example of such action – you can give a shop assistant a $10 bill and ask him/her whether it could be changed for ten $1 coins. You get it and you have assets of the same value. Fungible tokens work the same way. They all represent the same value that can be subdivided into smaller parts. But, there is one thing to remember – fungibility is one thing, but there is also the opposite group of tokens.

Non-fungible tokens (NFTs)

Non-fungible tokens (NFTs) are also present on the market. The difference is clear – each NFT is unique, not-interchangeable, and indivisible. It means that the owner of an NFT can feel like the car collector who has just received the Aston Martin model made especially for him. There’s no other car that looks the same, so it’s impossible to trade one for one and maintain all the value at once. That’s how it relates to the real world of NFTs. For example, they have gained popularity as the identifiers of items used in the gaming world or, metaverse. They may work as a brand of clothing, weapon, haircut, and many more attributes of a character.

5 more features of tokens

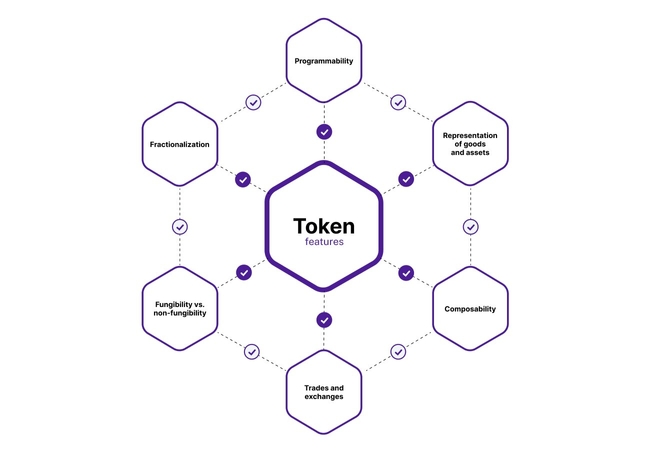

As you already know, fungibility and non-fungibility are two of more main features of tokens. Then, what are the other characteristics that may apply to both kinds? Let’s go through them respectively.

Representation of goods and assets

Tokenization of online transactions is rightly considered comfortable and trustworthy. Especially NFTs work perfectly as representations of goods and assets. It’s because they are used not only for mentioned virtual reality but also in a real business, for example as an equivalent for works of art or real estate. So, after buying the unique token, you can become an owner of some painting or prospective residence.

Programmability

The majority of tokens connected with cryptocurrencies are programmable. It means that each payment made with cryptocurrencies is encrypted with a self-executing, programmable code that is attached to the appropriate blockchain address. What is more, no bank is necessary to confirm the transaction, so a user might do it all on his/her own. Thanks to that we experience unprecedented ease in making online transactions.

Fractionalization

Because a token is usually single and indivisible, you might think that it can only belong to one specific person. Nothing is more deceptive. There appeared a fractional set of NFTs, so their ownership might be divided into several equal parties. You might compare it to some valuable masterpiece like the sculpture of Discobolus by Myron. The figure is unique and it can’t be copied and owned by more than one person. However, thanks to fractionalization there might be, let’s say 10 fungible tokens that lie behind 1 NFT. So, every person included in the deal owns 10% of a given good or asset. In other words, 10 people might feel like the original Discobolus is exhibited in their living rooms. Thanks to that solution, several clients are engaged in increasing the value of NFT and every single one of them is responsible for his/her part.

Composability

When a token is composable, it means that several other fungible or non-fungible tokens can be attached to it. As a result, a single token may represent more than one asset. The creation of a tree of components is possible. Imagine the situation when a person would want to invest his or her money into 15 crypto coins. At first glance, it’s unreachable as each coin has its unique code and token, so the transaction would be split into 15 different payments. However, thanks to composability, all coins can fall into one single parent token, so a buyer can buy them all at once. Simply put, composable tokens facilitate investors’ lives to an even further level.

Trades and exchanges

When a company decides to release a cryptocurrency, the further procedure is clear. Virtual money should be represented by tokens, so it can be traded and exchanged by investors on the crypto stock market. Examples of that activity include many tokens, for example, Binance’s BNB. The more exchange tokens a user has, the more benefits await him – companies usually provide trusted clients with discounts and rewards.

Incredible multifunctionality of tokens

As you already know, tokenization has many positive features, no matter the type we talk about. The ease and comfort of making transactions encouraged many clients to enter the world of cryptocurrencies. But with the growth of tokenization more and more possibilities have come into action. It all led to the introduction of NFTs which gave several new possibilities that shed new light on this branch of the economy. Tokens can be mainly divided into fungible and non-fungible ones, but it’s good to remember that these types are not total opposites and they both guarantee multiple many benefits. If the area of tokenization grows, the list of positive features and possibilities will be wider in the upcoming years.